Federal Reserve Chair Jerome Powell on Tuesday suggested the central bank is nearing a point where it will stop reducing the size of its bond holdings, but gave no long-run indication of where interest rates are heading.

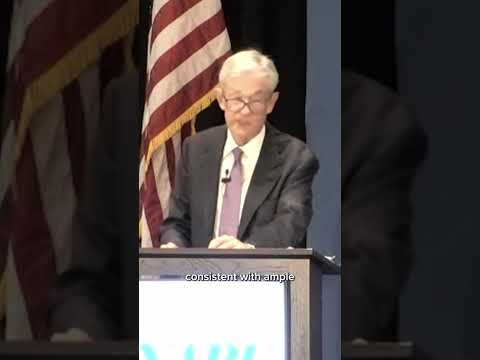

Speaking to the National Association for Business Economics’ conference in Philadelphia, Powell provided a dissertation on where the Fed stands with “quantitative tightening,” or the effort to reduce the more than $6 trillion of securities it holds on its balance sheet.

While he provided no specific date of when the program will cease, he said there are indications that the Fed is nearing its goal of “ample” reserves available for banks.